Berkshire Hathaway

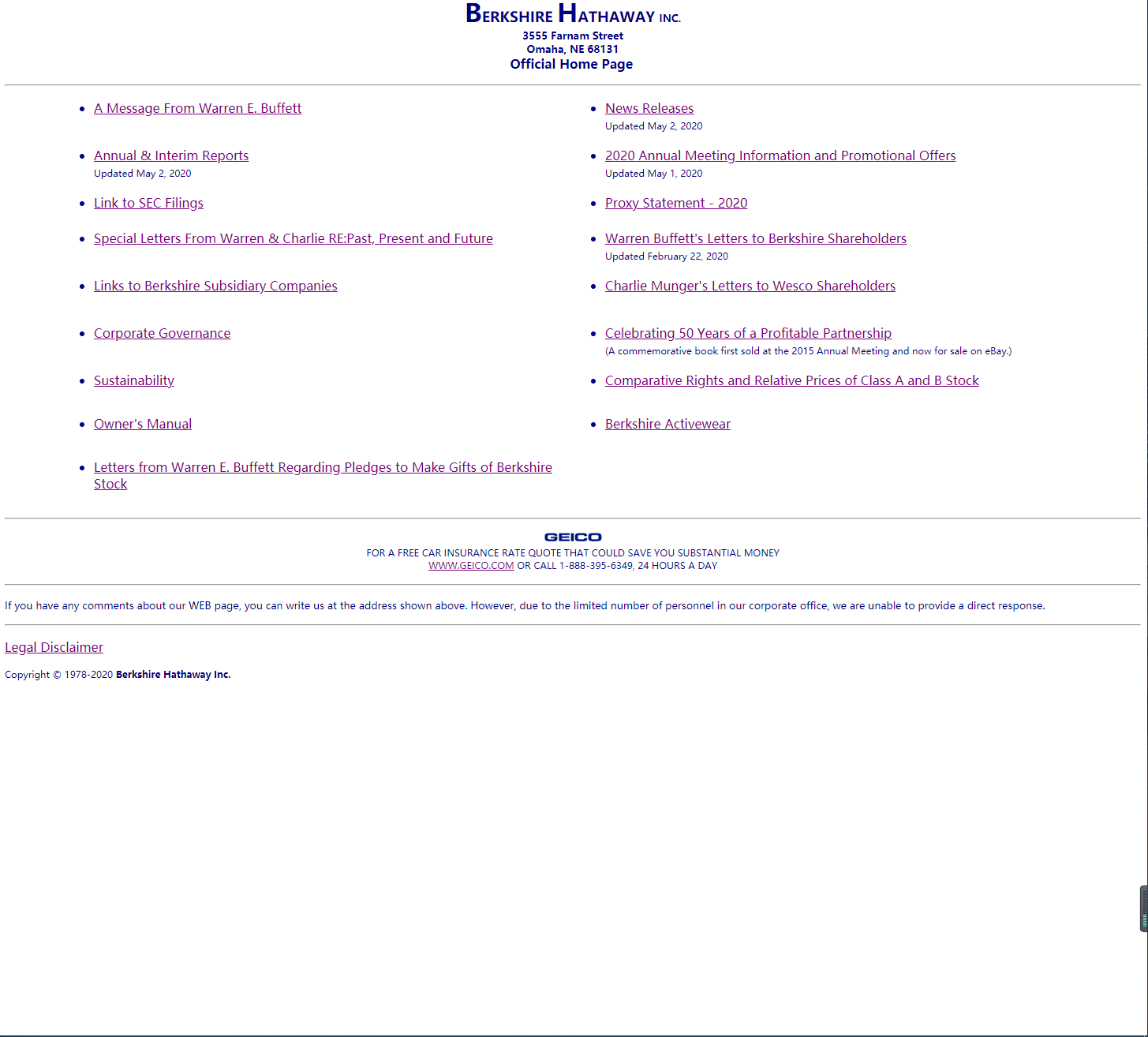

Business Menu List : Berkshire Hathaway

"Berkshire Hathaway is an American multinational corporation holding business headquartered in Omaha, Nebraska, USA. The business completely possesses GEICO, Duracell, Milk Queen, BNSF, Lubrizol, Fruit of the Loom, Helzberg Diamonds, Long & Foster, FlightSafety International, Pampered Chef, Woodland River and also NetJets, and likewise owns 38.6% of Pilot Traveling J; and significant minority holdings in U.S. public business Kraft Heinz Business (26.7%), American Express (17.6%), Wells Fargo (9.9%), The Coca-Cola Business (9.32%), Bank of America (6.8%), and also Apple (5.22%). [4] Beginning in 2016, the firm got huge holdings in the major US airline company service providers, particularly United Airlines, Delta Air Lines, Southwest Airlines as well as American Airlines [5] but offered all of its airline holdings early in 2020. [6] Berkshire Hathaway has actually averaged an annual development in publication value of 19.0% to its shareholders considering that 1965 (contrasted to 9.7% from the S&P 500 with returns included for the exact same period), while using big amounts of funding, and very little debt.

The business is known for its control and also leadership by Warren Buffett, who works as chairman as well as president, and also by Charlie Munger, among the company's vice-chairmen. In the very early part of his occupation at Berkshire, Buffett focused on long-lasting financial investments in openly traded business, but much more lately he has more often bought entire companies. Berkshire now has a varied variety of organisations including confectionery, retail, railways, furniture, encyclopedias, manufacturers of vacuum cleaners, fashion jewelry sales, manufacture and circulation of attires, and several local electrical and gas energies.

According to the Forbes Global 2000 checklist as well as formula, Berkshire Hathaway is the 3rd largest public business in the world, the tenth biggest corporation by profits as well as the biggest economic solutions firm by income on the planet.

As of April 2020, Berkshire's Course B stock is the eighth-largest component of the S&P 500 Index (which is based on free-float market capitalization) and also the firm is popular for having the most expensive share cost in history with Class A shares setting you back around $300,000 each. This is due to the fact that there has never ever been a stock split in its Course A shares and Buffett mentioned in a 1984 letter to shareholders that he does not plan to divide the supply."

The business is known for its control and also leadership by Warren Buffett, who works as chairman as well as president, and also by Charlie Munger, among the company's vice-chairmen. In the very early part of his occupation at Berkshire, Buffett focused on long-lasting financial investments in openly traded business, but much more lately he has more often bought entire companies. Berkshire now has a varied variety of organisations including confectionery, retail, railways, furniture, encyclopedias, manufacturers of vacuum cleaners, fashion jewelry sales, manufacture and circulation of attires, and several local electrical and gas energies.

According to the Forbes Global 2000 checklist as well as formula, Berkshire Hathaway is the 3rd largest public business in the world, the tenth biggest corporation by profits as well as the biggest economic solutions firm by income on the planet.

As of April 2020, Berkshire's Course B stock is the eighth-largest component of the S&P 500 Index (which is based on free-float market capitalization) and also the firm is popular for having the most expensive share cost in history with Class A shares setting you back around $300,000 each. This is due to the fact that there has never ever been a stock split in its Course A shares and Buffett mentioned in a 1984 letter to shareholders that he does not plan to divide the supply."

Features I like:

No

Features I don't like:

No